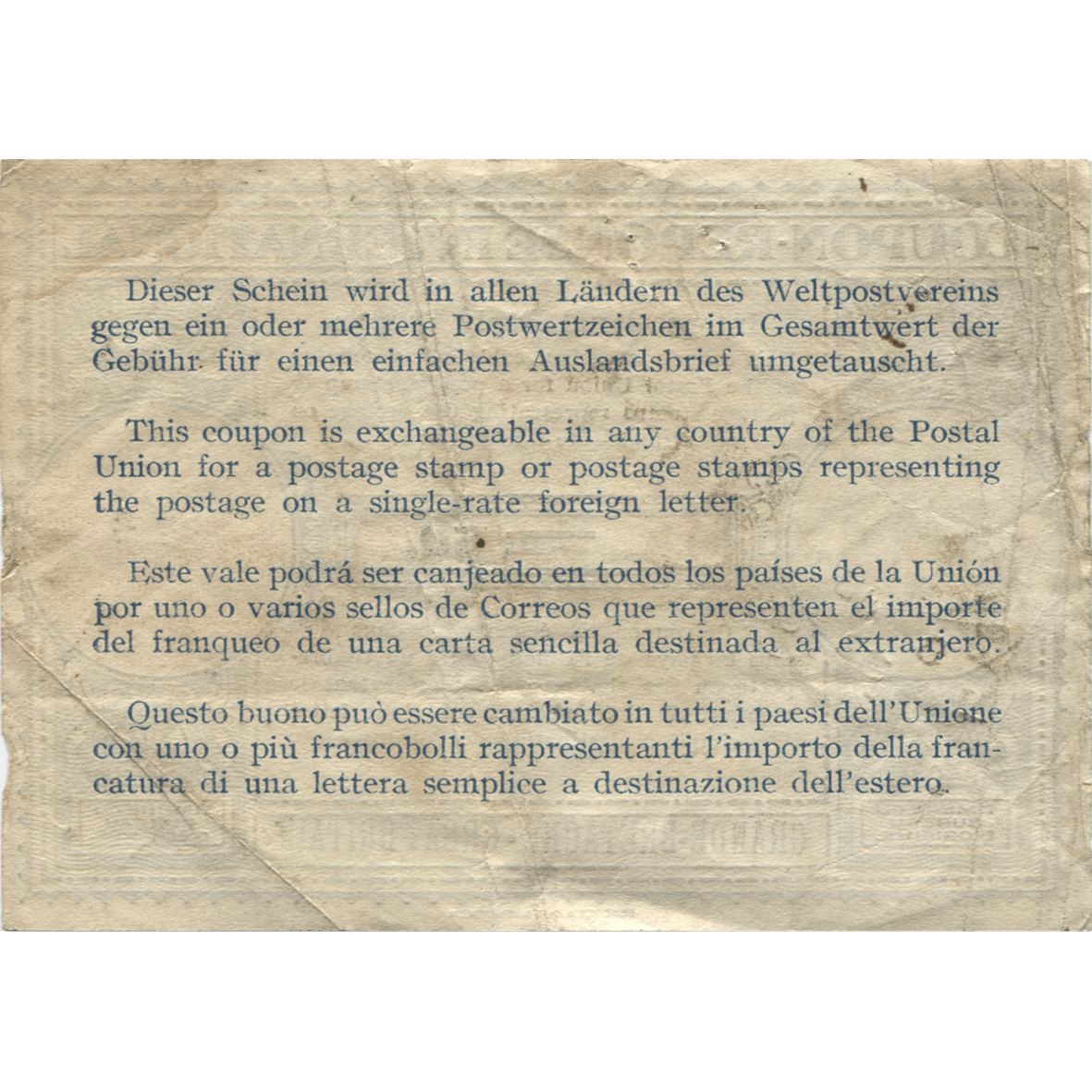

Internationale Antwortscheine (IAS) wurden seit 1906 vom Weltpostverein ausgegeben. Sie konnten weltweit bei jeder Post für Briefmarken im Wert eines Briefportos ins Ausland eingetauscht werden. Da diese Briefgebühr von Land zu Land verschieden war, konnte man 1920 in Europa einen IAS für umgerechnet 1 US-Cent kaufen, der in den USA 6 Cent wert war.

Der Gewinn, der durch die in verschiedenen Ländern verschieden hohen Briefgebühren gemacht werden konnte, war der Kern eines klassischen Schneeballsystems, das später nach seinem Erfinder Charles Ponzi als 'Ponzi-System' bekannt wurde.

Ponzi beschwatzte Amerikaner und Amerikanerinnen dazu, Geld in den Kauf von europäischen IAS zu investieren. Er versprach 50 Prozent Rendite in 45 Tagen, oder die Verdoppelung des investierten Geldes in 90 Tagen. Und das Geschäft lief gut. Weil Ponzi zahlte, wenn jemand sein Geld zurück haben wollte, fassen die Leute Vertrauen zu ihm. Bald nahm Ponzi an manchen Tagen hunderttausende von Dollars ein. Die meisten Investoren forderten nach Ablauf der Frist ihr Geld nicht ein, sondern investierten den Gewinn wieder. Manche verpfändeten ihr gesamtes Hab und Gut, um nach der Ponzi-Methode reich zu werden. Wenn ein Kunde seinen Gewinn eingeforderte, bezahlte ihn Ponzi aus den gerade einbezahlten Geldern neuer Investoren. Als Presse und Finanzamt auf ihn aufmerksam wurden, war es schon zu spät: Von den ursprünglich eingesammelten 15 Millionen Dollar (nach heutigem Geldwert wären das etwa 150 Millionen Dollar) war nur noch ein Bruchteil vorhanden.